TIAA savings rate is a critical factor when planning for a secure financial future. Whether you're just starting your career or nearing retirement, understanding how TIAA savings rates work can significantly impact your financial well-being. This article will delve into the intricacies of TIAA savings rates, offering valuable insights to help you make informed decisions about your retirement savings.

As one of the leading providers of retirement plans for employees in the academic, medical, cultural, and research fields, TIAA offers a range of savings options designed to meet the diverse needs of its participants. By exploring the nuances of TIAA savings rates, you can better understand how to optimize your contributions and maximize your returns.

Whether you're looking to increase your savings or simply want to ensure that your retirement funds are growing at an optimal rate, this guide will provide you with the information you need to take control of your financial future. Let's dive in and explore the world of TIAA savings rates.

Read also:African Art Tattoo

Table of Contents

- Introduction to TIAA Savings Rate

- History of TIAA

- TIAA Savings Options

- Understanding TIAA Savings Rate Details

- Benefits of TIAA Savings Plans

- Comparison with Other Savings Plans

- How to Calculate TIAA Savings Rate

- Strategies to Maximize TIAA Savings Rate

- Tax Implications of TIAA Savings

- Frequently Asked Questions

Introduction to TIAA Savings Rate

TIAA savings rate plays a pivotal role in determining the growth of your retirement savings. It represents the percentage of interest or return that your savings earn over time. Understanding this rate is essential for anyone looking to secure their financial future.

TIAA offers a variety of savings plans, each with its own unique features and benefits. These plans are designed to cater to the specific needs of employees in the academic, medical, cultural, and research sectors. By familiarizing yourself with the TIAA savings rate, you can make informed decisions about which plan is right for you.

Whether you're a young professional just starting out or a seasoned employee nearing retirement, the TIAA savings rate can help you achieve your financial goals. Let's explore the history of TIAA and how it has evolved over the years.

History of TIAA

Founded in 1918, TIAA (Teachers Insurance and Annuity Association) began as a way to provide financial security for educators. Over the years, it has grown into one of the largest providers of retirement plans for employees in the academic, medical, cultural, and research fields.

Key Milestones in TIAA's History

- 1918: TIAA was established to provide retirement benefits for college professors.

- 1940s: TIAA expanded its services to include annuity contracts.

- 1990s: TIAA introduced mutual funds and other investment options.

- 2015: TIAA merged with CREF (College Retirement Equities Fund) to become TIAA-CREF.

Throughout its history, TIAA has remained committed to providing innovative solutions to help employees save for retirement. This commitment to excellence is reflected in the TIAA savings rate, which continues to be a key factor in determining the success of its retirement plans.

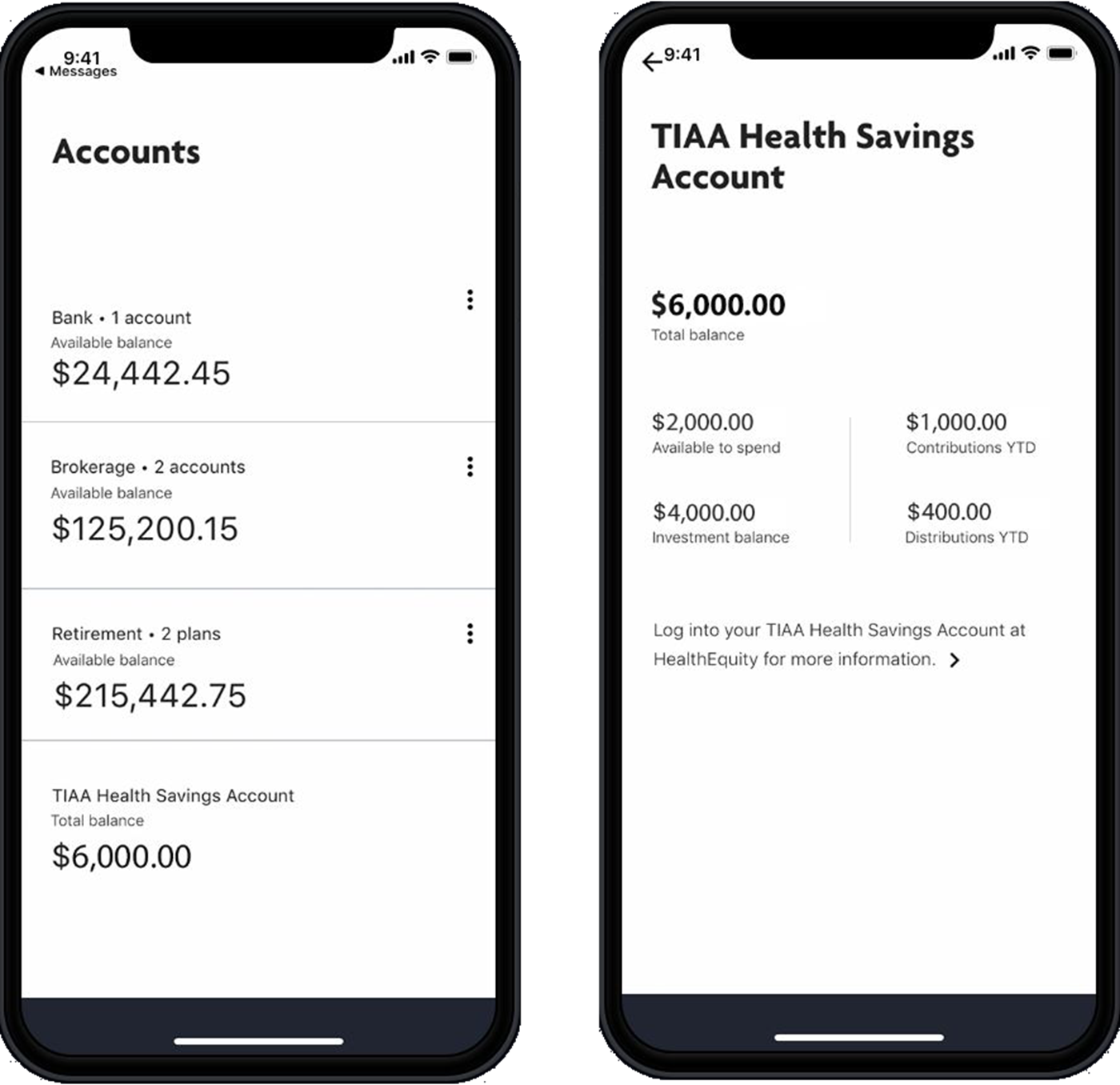

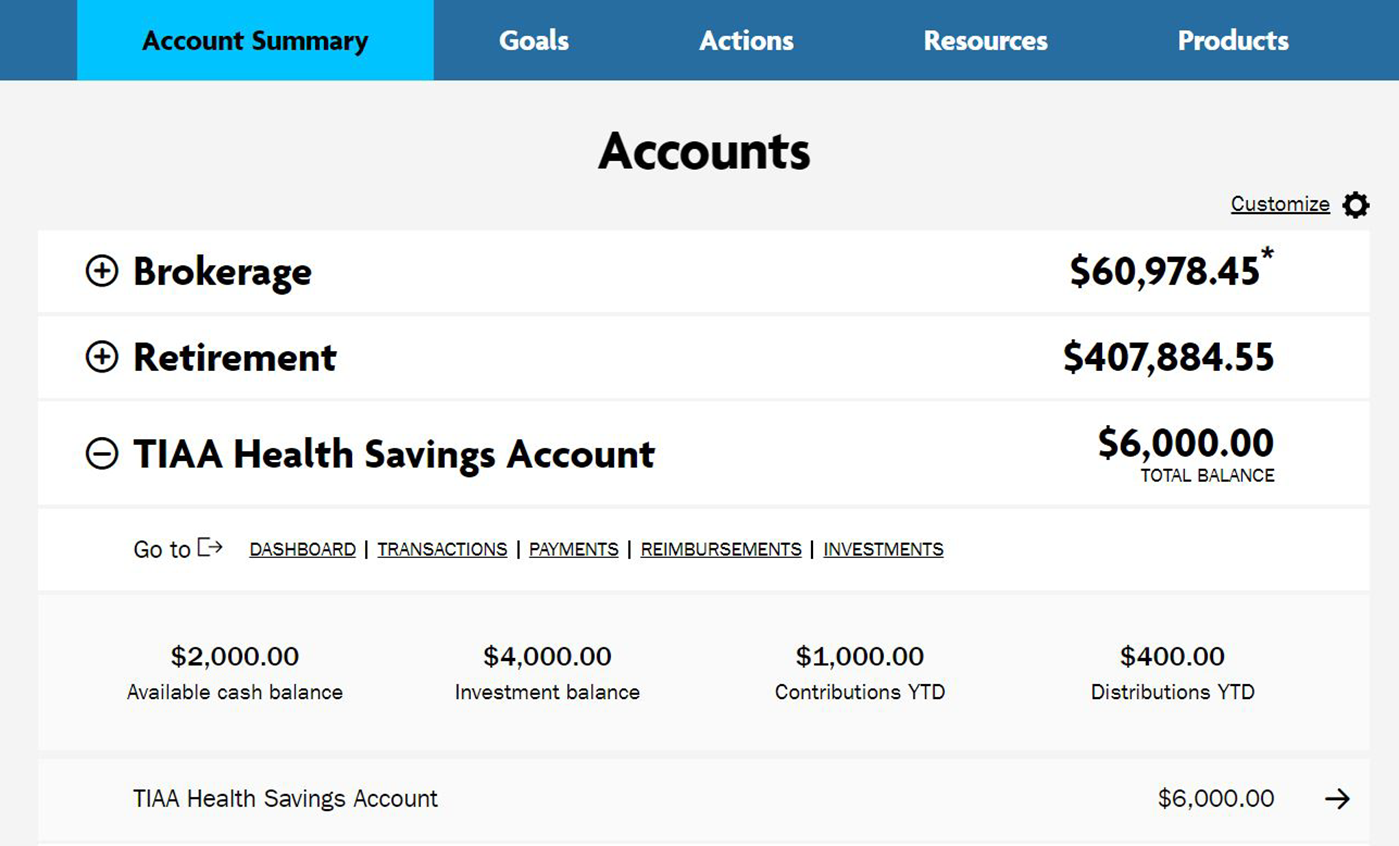

TIAA Savings Options

TIAA offers a range of savings options designed to meet the diverse needs of its participants. These options include traditional annuities, mutual funds, and other investment vehicles. Each option has its own TIAA savings rate, allowing participants to choose the plan that best suits their financial goals.

Read also:Where Is Pablo Escobar Wife

Popular TIAA Savings Plans

- TIAA Traditional Annuity: Offers a guaranteed rate of return with fixed payments.

- TIAA-CREF Mutual Funds: Provides access to a variety of investment options with varying levels of risk.

- TIAA Variable Annuities: Allows participants to invest in a range of sub-accounts with potential for higher returns.

Understanding the TIAA savings rate for each of these options is crucial when deciding which plan to choose. Let's explore the details of TIAA savings rates in the next section.

Understanding TIAA Savings Rate Details

The TIAA savings rate is influenced by a variety of factors, including market conditions, investment performance, and participant contributions. It's important to understand how these factors impact your savings rate and how you can optimize your contributions to maximize your returns.

Factors Affecting TIAA Savings Rates

- Market Performance: The overall performance of the financial markets can impact the TIAA savings rate.

- Investment Mix: The types of investments you choose can affect your savings rate, with higher-risk investments potentially offering higher returns.

- Participant Contributions: The amount you contribute to your TIAA savings plan can influence your overall rate of return.

By understanding these factors, you can make informed decisions about your TIAA savings plan and work towards achieving your financial goals.

Benefits of TIAA Savings Plans

TIAA savings plans offer numerous benefits that make them an attractive option for employees in the academic, medical, cultural, and research fields. These benefits include tax advantages, investment flexibility, and professional guidance.

Key Benefits of TIAA Savings Plans

- Tax-Deferred Growth: Contributions to TIAA savings plans grow tax-deferred, allowing your savings to compound over time.

- Professional Guidance: TIAA offers access to financial advisors who can help you navigate the complexities of retirement planning.

- Investment Flexibility: Participants have the option to choose from a wide range of investment options, allowing them to tailor their savings plan to their specific needs.

These benefits, combined with a competitive TIAA savings rate, make TIAA savings plans a valuable tool for achieving financial security in retirement.

Comparison with Other Savings Plans

While TIAA savings plans offer many advantages, it's important to compare them with other retirement savings options to ensure you're making the best choice for your financial future. Factors to consider include fees, investment options, and the TIAA savings rate compared to other providers.

TIAA vs. Other Providers

- Fees: TIAA typically offers competitive fees compared to other retirement plan providers.

- Investment Options: TIAA provides a wide range of investment options, allowing participants to customize their savings plans.

- TIAA Savings Rate: The TIAA savings rate is often competitive with other providers, offering participants the potential for strong returns.

By carefully evaluating these factors, you can determine whether a TIAA savings plan is the right choice for you.

How to Calculate TIAA Savings Rate

Calculating your TIAA savings rate involves understanding the factors that influence your rate of return, such as market performance, investment mix, and participant contributions. While TIAA provides tools and resources to help you estimate your savings rate, it's important to understand the underlying calculations.

Steps to Calculate TIAA Savings Rate

- Review Your Investment Portfolio: Assess the performance of your current investments and determine their contribution to your overall savings rate.

- Consider Market Conditions: Factor in current market conditions and their potential impact on your TIAA savings rate.

- Adjust Contributions: Modify your contributions as needed to optimize your savings rate and achieve your financial goals.

By following these steps, you can gain a better understanding of your TIAA savings rate and make adjustments to improve your financial future.

Strategies to Maximize TIAA Savings Rate

To maximize your TIAA savings rate, it's important to implement strategies that take advantage of the benefits offered by TIAA savings plans. These strategies include increasing contributions, diversifying investments, and seeking professional guidance.

Maximizing Your TIAA Savings Rate

- Increase Contributions: Boost your contributions to take full advantage of tax-deferred growth and compound interest.

- Diversify Investments: Spread your investments across a variety of asset classes to reduce risk and enhance potential returns.

- Seek Professional Guidance: Work with a financial advisor to develop a comprehensive retirement plan tailored to your needs.

By implementing these strategies, you can maximize your TIAA savings rate and secure your financial future.

Tax Implications of TIAA Savings

TIAA savings plans offer significant tax advantages, including tax-deferred growth and potential tax deductions for contributions. However, it's important to understand the tax implications of these plans to ensure you're maximizing your savings and minimizing your tax liability.

Key Tax Considerations

- Tax-Deferred Growth: Contributions to TIAA savings plans grow tax-deferred, allowing your savings to compound over time.

- Tax Deductions: Depending on your income level and plan type, you may be eligible for tax deductions on your contributions.

- Withdrawals: Withdrawals from TIAA savings plans are generally subject to income tax and may incur penalties if taken before age 59½.

By understanding the tax implications of TIAA savings plans, you can make informed decisions about your retirement savings strategy.

Frequently Asked Questions

Here are some common questions about TIAA savings rates and plans:

Q: How often does TIAA adjust its savings rates?

A: TIAA adjusts its savings rates periodically based on market conditions and investment performance. Participants can review rate changes in their account statements or by contacting TIAA directly.

Q: Can I change my investment options within a TIAA savings plan?

A: Yes, participants can modify their investment options at any time by contacting TIAA or making changes through their online account.

Q: Are TIAA savings plans only available to educators?

A: While TIAA began by serving educators, its savings plans are now available to employees in the academic, medical, cultural, and research fields.

Conclusion

In conclusion, understanding the TIAA savings rate is essential for anyone looking to secure their financial future. By exploring the history of TIAA, its savings options, and the factors affecting savings rates, you can make informed decisions about your retirement savings. Remember to implement strategies to maximize your savings rate and take advantage of the tax benefits offered by TIAA plans.

We encourage you to take action by reviewing your current savings plan, adjusting contributions as needed, and seeking professional guidance to ensure you're on track to achieve your financial goals. Don't forget to share this article with others who may benefit from the information and explore more resources on our site.