Securing a loan can be a crucial step toward achieving your financial goals, and Chase offers a wide range of options tailored to meet various needs. Whether you're looking to consolidate debt, finance a major purchase, or expand your business, understanding the process of "chase get a loan" is essential. This article will provide you with an in-depth guide on how to navigate the loan application process with Chase, ensuring you make informed decisions.

Chase, one of the largest financial institutions in the United States, provides a variety of loan products designed to cater to individual and business needs. From personal loans to mortgages, the options are vast, and each comes with its own set of requirements and benefits. By understanding the nuances of these offerings, you can choose the best loan product for your financial situation.

In this guide, we will explore the process of getting a loan from Chase, discuss the eligibility criteria, and provide tips to improve your chances of approval. Additionally, we'll cover the importance of maintaining good credit health and managing loan repayments effectively. Let's dive into the details.

Read also:God Grace Mercy Quotes

Table of Contents

- Introduction to Chase Loans

- Types of Loans Offered by Chase

- Eligibility Requirements

- How to Apply for a Loan with Chase

- Improving Your Credit Score

- Loan Repayment Tips

- Common Mistakes to Avoid

- Chase Customer Support

- Frequently Asked Questions

- Conclusion

Introduction to Chase Loans

Chase Bank is renowned for its robust financial services, including a diverse array of loan products. When you decide to "chase get a loan," you're choosing one of the most reliable and customer-centric institutions in the banking industry. Chase offers competitive interest rates and flexible repayment terms, making it an attractive option for borrowers.

Why Choose Chase for Your Loan Needs?

There are several reasons why Chase stands out in the lending market:

- Wide Range of Loan Options: From personal loans to mortgages, Chase has a product for every financial need.

- Competitive Interest Rates: Chase often provides lower interest rates compared to other lenders, helping you save money over the life of the loan.

- Customer-Focused Service: With a focus on customer satisfaction, Chase ensures a seamless borrowing experience.

Types of Loans Offered by Chase

Chase offers several types of loans to cater to different financial requirements. Understanding the various loan products can help you choose the right one for your needs.

Personal Loans

Personal loans from Chase are unsecured loans that can be used for various purposes, such as debt consolidation, home improvements, or medical expenses. These loans typically have fixed interest rates and repayment terms ranging from 36 to 60 months.

Mortgage Loans

Chase is a leading provider of mortgage loans, offering options like fixed-rate and adjustable-rate mortgages. With competitive rates and flexible terms, Chase helps you secure your dream home.

Business Loans

For entrepreneurs and small business owners, Chase provides business loans to support growth and expansion. These loans can be tailored to meet specific business needs, such as purchasing equipment or expanding operations.

Read also:Bella Grace Weems Religion

Eligibility Requirements

To "chase get a loan," you must meet certain eligibility criteria. These requirements ensure that borrowers are capable of repaying their loans on time.

Credit Score

Your credit score plays a significant role in determining your eligibility for a Chase loan. Generally, a credit score of 670 or higher is considered good, increasing your chances of approval.

Income Verification

Chase will require proof of income to assess your ability to repay the loan. This may include pay stubs, tax returns, or bank statements.

How to Apply for a Loan with Chase

The application process for a Chase loan is straightforward and can be completed online or in person. Follow these steps to apply:

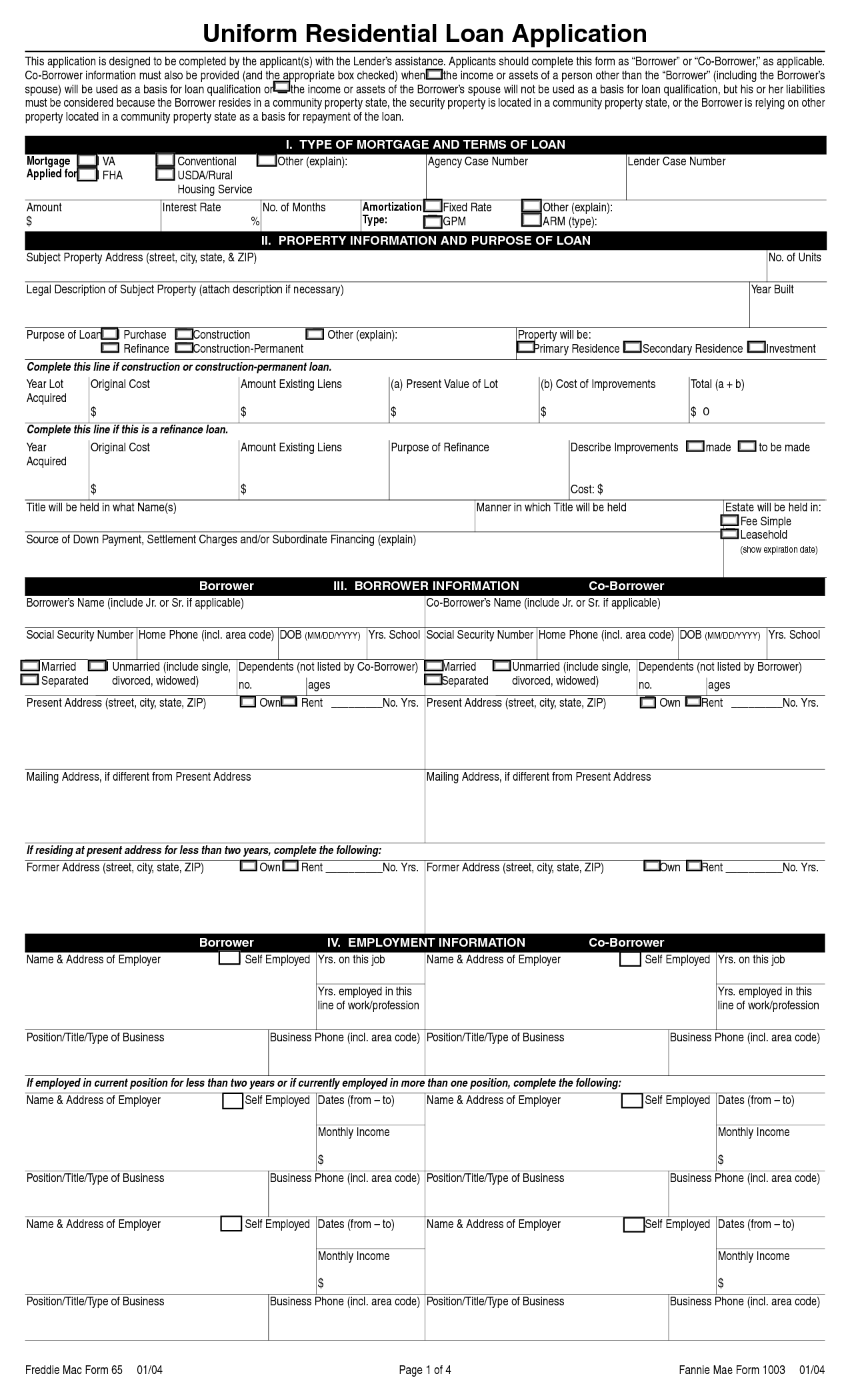

Step 1: Gather Required Documents

Before starting the application, ensure you have all necessary documents, such as identification, proof of income, and financial statements.

Step 2: Complete the Application

Fill out the online application form or visit a Chase branch to apply in person. Provide accurate and complete information to expedite the process.

Step 3: Review and Submit

Double-check your application for errors before submitting it. Once submitted, Chase will review your application and notify you of the decision.

Improving Your Credit Score

A strong credit score is essential for securing favorable loan terms. Here are some tips to improve your credit score:

Pay Bills on Time

Consistently paying your bills on time is one of the most effective ways to boost your credit score. Late payments can have a negative impact on your credit history.

Reduce Debt

Lowering your overall debt can improve your credit utilization ratio, a key factor in credit scoring.

Loan Repayment Tips

Managing loan repayments effectively is crucial to maintaining financial stability. Consider these tips:

Set Up Automatic Payments

Automating your loan payments ensures you never miss a payment, helping you avoid late fees and penalties.

Make Extra Payments

Paying more than the minimum required can reduce the total interest paid over the life of the loan and shorten the repayment period.

Common Mistakes to Avoid

When pursuing a loan with Chase, avoid these common pitfalls:

Applying for Multiple Loans

Applying for multiple loans simultaneously can negatively affect your credit score. Focus on one application at a time.

Ignoring Loan Terms

Always read and understand the loan terms and conditions before signing the agreement. This includes interest rates, fees, and repayment schedules.

Chase Customer Support

Chase offers excellent customer support to assist borrowers throughout the loan process. Whether you have questions about eligibility or need help with repayment, Chase's dedicated team is available to help.

Frequently Asked Questions

Q: What is the minimum credit score required for a Chase loan?

A: While Chase does not disclose a specific minimum credit score, a score of 670 or higher generally improves your chances of approval.

Q: Can I apply for a Chase loan online?

A: Yes, you can apply for a Chase loan online through their official website. The process is simple and convenient.

Conclusion

Securing a loan from Chase can be a smart financial decision when done responsibly. By understanding the process of "chase get a loan," you can make informed choices that align with your financial goals. Remember to maintain good credit health, review loan terms carefully, and manage repayments effectively.

We encourage you to share your thoughts and experiences in the comments below. For more informative articles on finance and loans, explore our other content and stay updated on the latest trends in the financial world.

Disclaimer: The information provided in this article is for educational purposes only. Always consult with a financial advisor for personalized advice.