Refinancing your mortgage can be a game-changer, especially when you're looking to secure better terms or lower interest rates. Chase mortgage rates for refinancing are among the most sought-after options in the market due to their competitive offerings and customer-centric approach. Whether you're aiming to reduce your monthly payments or tap into your home's equity, understanding the nuances of Chase's refinancing options is crucial. In this article, we'll explore everything you need to know about Chase mortgage rates for refinancing, ensuring you're well-informed before making any financial decisions.

Refinancing isn't just about switching lenders; it's about optimizing your financial situation. By choosing Chase, borrowers benefit from a robust financial institution with a reputation for reliability and competitive rates. This article will delve into the specifics of Chase's mortgage refinancing options, including their current rates, eligibility criteria, and the application process.

As one of the largest banks in the United States, Chase offers a variety of mortgage products tailored to meet the needs of homeowners. Whether you're a first-time borrower or an experienced homeowner, understanding how Chase mortgage rates for refinancing work can help you make informed decisions about your financial future. Let's dive into the details and explore how you can take advantage of these offerings.

Read also:Dd Osama Whatsapp Number 2024

Table of Contents

- Introduction to Chase Mortgage Rates for Refinancing

- Types of Chase Mortgage Refinancing Options

- Understanding Current Chase Mortgage Rates

- Eligibility Criteria for Refinancing with Chase

- The Application Process for Chase Mortgage Refinancing

- Benefits of Refinancing with Chase

- Potential Costs Associated with Refinancing

- Tips for Securing the Best Chase Mortgage Rates

- Frequently Asked Questions About Chase Mortgage Refinancing

- Conclusion: Making the Right Decision

Introduction to Chase Mortgage Rates for Refinancing

Why Choose Chase for Mortgage Refinancing?

When it comes to refinancing your mortgage, Chase stands out as a leading choice for many homeowners. With its extensive network of branches, robust online platform, and competitive mortgage rates, Chase offers a seamless refinancing experience. The bank's commitment to customer service and transparency ensures that borrowers feel confident in their financial decisions.

Chase mortgage rates for refinancing are designed to cater to a wide range of borrowers, from those seeking to lower their interest rates to those looking to consolidate debt. By understanding the bank's offerings, you can determine whether refinancing with Chase aligns with your financial goals.

Types of Chase Mortgage Refinancing Options

Rate-and-Term Refinancing

Rate-and-term refinancing is one of the most common types of refinancing offered by Chase. This option allows borrowers to replace their existing mortgage with a new one that has a lower interest rate or a different loan term. By doing so, homeowners can reduce their monthly payments or shorten the duration of their loan.

Cash-Out Refinancing

Cash-out refinancing is another popular option available through Chase. This type of refinancing allows homeowners to access the equity in their homes by borrowing more than the remaining balance on their current mortgage. The excess funds can be used for home improvements, debt consolidation, or other financial needs.

Understanding Current Chase Mortgage Rates

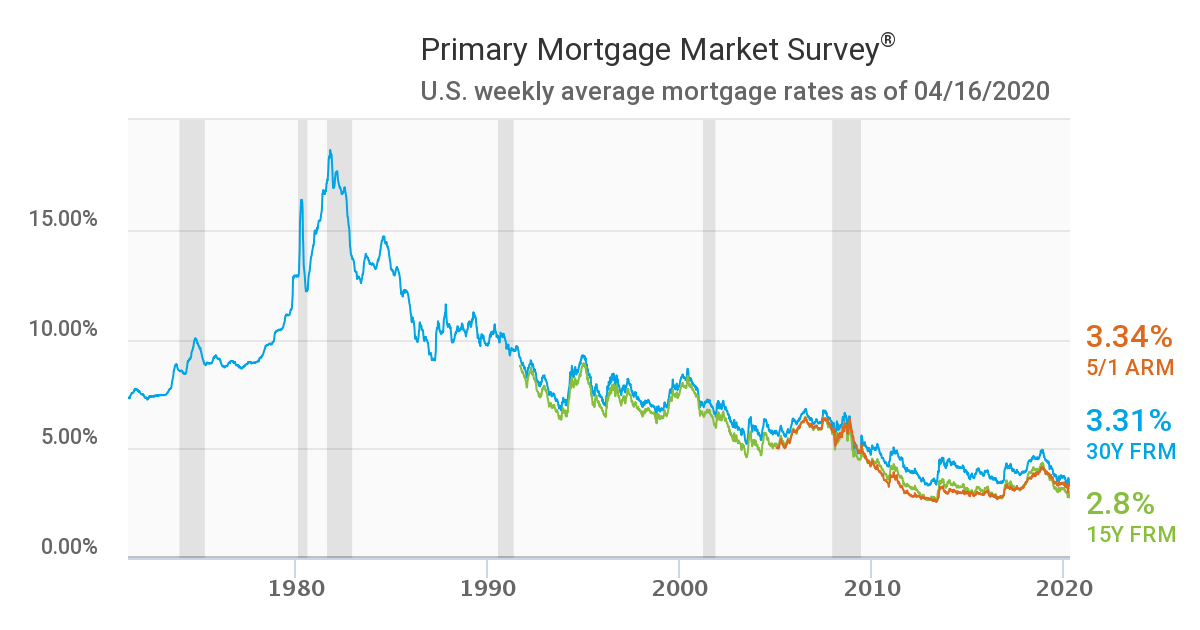

Chase mortgage rates for refinancing fluctuate based on market conditions, economic indicators, and individual borrower profiles. As of the latest data, Chase offers competitive rates for both fixed-rate and adjustable-rate mortgages. Fixed-rate mortgages provide stability with consistent payments over the life of the loan, while adjustable-rate mortgages offer lower initial rates that may change over time.

To get the most up-to-date information on Chase mortgage rates, it's essential to consult the bank's official website or speak with a mortgage specialist. Factors such as credit score, loan-to-value ratio, and income verification can significantly impact the rates you're offered.

Read also:Beautiful African Last Names

Eligibility Criteria for Refinancing with Chase

Before applying for a Chase mortgage refinancing, it's important to ensure you meet the eligibility criteria. Generally, borrowers must have a stable income, a good credit score, and sufficient equity in their home. Chase typically requires a minimum credit score of 620 for most refinancing options, although higher scores may qualify for better rates.

- Stable income verified through pay stubs or tax returns

- Equity in your home of at least 20% to avoid private mortgage insurance (PMI)

- Good credit history with no recent late payments

The Application Process for Chase Mortgage Refinancing

Step-by-Step Guide

The application process for Chase mortgage refinancing is designed to be straightforward and efficient. Borrowers can apply online, over the phone, or in person at a Chase branch. Below is a step-by-step guide to help you navigate the process:

- Gather necessary documents, including proof of income, tax returns, and current mortgage statements.

- Complete the application form, either online or with the assistance of a Chase representative.

- Undergo a credit check and loan evaluation to determine your eligibility and rate options.

- Review and sign the loan documents once approved, and schedule the closing date.

Benefits of Refinancing with Chase

Refinancing your mortgage with Chase offers numerous benefits, including:

- Lower monthly payments through reduced interest rates

- Access to home equity through cash-out refinancing

- Improved loan terms, such as switching from an adjustable-rate to a fixed-rate mortgage

- Streamlined customer service and support from a trusted financial institution

By leveraging Chase mortgage rates for refinancing, homeowners can optimize their financial situation and achieve long-term savings.

Potential Costs Associated with Refinancing

While refinancing can lead to significant savings, it's important to consider the associated costs. These may include:

- Loan origination fees

- Appraisal fees

- Closing costs

- Prepayment penalties (if applicable to your current mortgage)

Chase provides transparent information about these costs during the application process, allowing borrowers to make informed decisions about whether refinancing is financially viable.

Tips for Securing the Best Chase Mortgage Rates

To maximize your chances of securing the best Chase mortgage rates for refinancing, consider the following tips:

- Improve your credit score by paying bills on time and reducing debt

- Shop around and compare rates from multiple lenders to ensure you're getting the best deal

- Consider making a larger down payment to reduce your loan-to-value ratio

- Work closely with a Chase mortgage specialist to understand all available options

By taking these steps, you can position yourself for success and secure favorable terms on your refinanced mortgage.

Frequently Asked Questions About Chase Mortgage Refinancing

Q: How long does the refinancing process take?

A: The refinancing process typically takes between 30 and 60 days, depending on the complexity of your loan and the speed at which you provide required documentation.

Q: Can I refinance with Chase if I have an existing mortgage with another lender?

A: Yes, Chase offers refinancing options for homeowners with existing mortgages from other lenders. Simply apply through the standard process and provide the necessary documentation.

Q: Are there any penalties for refinancing my mortgage?

A: Some mortgages carry prepayment penalties, but Chase does not impose such fees on its refinancing products. However, it's important to check the terms of your current mortgage to ensure there are no hidden costs.

Conclusion: Making the Right Decision

Chase mortgage rates for refinancing offer a compelling opportunity for homeowners to improve their financial situation. By understanding the available options, eligibility criteria, and associated costs, you can make an informed decision about whether refinancing is right for you. Remember to work closely with a Chase mortgage specialist to explore all possibilities and secure the best terms possible.

We encourage you to share this article with others who may benefit from its insights and to leave a comment below if you have any questions or feedback. Additionally, consider exploring other resources on our site to further enhance your financial knowledge and planning.