The Franchise Tax Board California (FTB) is a critical government agency responsible for administering state tax laws and ensuring compliance among businesses and individuals. Understanding its role and functions is essential for anyone living or operating a business in California. This article delves into the intricacies of the FTB, providing a detailed overview to help you navigate California's tax landscape effectively.

Whether you're a small business owner, an individual taxpayer, or simply curious about California's tax regulations, this guide will equip you with the knowledge you need. We'll explore the FTB's responsibilities, its impact on businesses, and how to stay compliant with state tax laws.

By the end of this article, you'll have a clear understanding of the Franchise Tax Board California, enabling you to make informed decisions regarding your tax obligations. Let's dive in!

Read also:Dd Osama Whatsapp Number 2024

Table of Contents

- Introduction to Franchise Tax Board California

- History of Franchise Tax Board California

- Key Functions of the Franchise Tax Board

- Taxes Administered by the FTB

- Implications for Businesses

- Impact on Individual Taxpayers

- Tips for Staying Compliant

- Penalties and Interest

- Resources for Taxpayers

- The Future of the Franchise Tax Board

Introduction to Franchise Tax Board California

The Franchise Tax Board California is one of the most significant tax agencies in the state. Established to oversee tax laws and ensure compliance, the FTB plays a crucial role in maintaining California's financial health. Its primary responsibilities include administering state tax laws, collecting revenues, and providing assistance to taxpayers.

What is the Franchise Tax Board?

The Franchise Tax Board is an independent state agency that focuses on administering California's tax laws. It ensures that businesses and individuals meet their tax obligations by collecting taxes, enforcing compliance, and offering educational resources.

Key Areas of Focus

The FTB focuses on several key areas:

- Corporate taxes

- Personal income taxes

- Partnership taxes

- Estate and trust taxes

History of Franchise Tax Board California

The history of the Franchise Tax Board California dates back to the early 20th century. Established to address the growing complexity of state tax laws, the FTB has evolved significantly over the years. Its role has expanded to include not only tax collection but also taxpayer education and assistance.

Evolution of the FTB

From its modest beginnings, the Franchise Tax Board has grown into a robust agency equipped to handle the complexities of modern tax laws. Advances in technology and changes in state regulations have shaped its operations, making it more efficient and accessible to taxpayers.

Key Functions of the Franchise Tax Board

The Franchise Tax Board California performs several critical functions that ensure the proper administration of state tax laws. These functions are designed to maintain fairness, transparency, and accountability in the tax system.

Read also:Marcel Young Dr Dre Son

Tax Collection

One of the primary functions of the FTB is tax collection. It is responsible for collecting various types of taxes, including:

- Corporate franchise taxes

- Personal income taxes

- Estate and inheritance taxes

Taxpayer Assistance

The FTB offers a range of resources to assist taxpayers in understanding and fulfilling their obligations. These resources include online tools, publications, and customer service support.

Taxes Administered by the FTB

The Franchise Tax Board California administers a variety of taxes that affect both businesses and individuals. Understanding these taxes is crucial for maintaining compliance and avoiding penalties.

Corporate Franchise Tax

Businesses operating in California are subject to the corporate franchise tax. This tax is calculated based on the entity's net income and is a key source of revenue for the state.

Personal Income Tax

Individuals residing in California are required to pay personal income tax on their earnings. The FTB administers this tax and provides guidance on deductions, credits, and exemptions.

Implications for Businesses

For businesses, the Franchise Tax Board California has significant implications. Compliance with state tax laws is essential to avoid penalties and legal issues. Businesses must understand their obligations and take proactive steps to meet them.

Registration Requirements

Businesses must register with the FTB to obtain a tax identification number. This number is used for all tax-related transactions and filings.

Reporting Obligations

Businesses are required to file annual tax returns with the FTB. Failure to meet these reporting obligations can result in penalties and interest charges.

Impact on Individual Taxpayers

Individual taxpayers in California are also affected by the Franchise Tax Board's regulations. Understanding personal income tax requirements is essential for maintaining compliance and maximizing deductions.

Tax Deductions and Credits

The FTB offers various deductions and credits that can reduce an individual's tax liability. These include deductions for dependents, medical expenses, and charitable contributions.

Filing Deadlines

Individuals must file their tax returns by the specified deadline to avoid penalties. The FTB provides extensions in certain circumstances, but taxpayers must apply for them in advance.

Tips for Staying Compliant

Staying compliant with the Franchise Tax Board California's regulations requires careful attention to detail. Here are some tips to help you maintain compliance:

- Keep accurate records of all financial transactions

- File tax returns on time

- Stay informed about changes in tax laws

- Seek professional advice when needed

Penalties and Interest

Failure to comply with the Franchise Tax Board California's regulations can result in significant penalties and interest charges. Understanding these consequences is essential for avoiding financial hardship.

Common Penalties

Some common penalties imposed by the FTB include:

- Late filing penalties

- Underpayment penalties

- Failure to pay penalties

Interest Charges

Interest is charged on unpaid taxes, and the rate is subject to change based on federal short-term rates. It's important to pay taxes on time to avoid accruing interest.

Resources for Taxpayers

The Franchise Tax Board California offers a wealth of resources to assist taxpayers in understanding and fulfilling their obligations. These resources include:

Online Tools

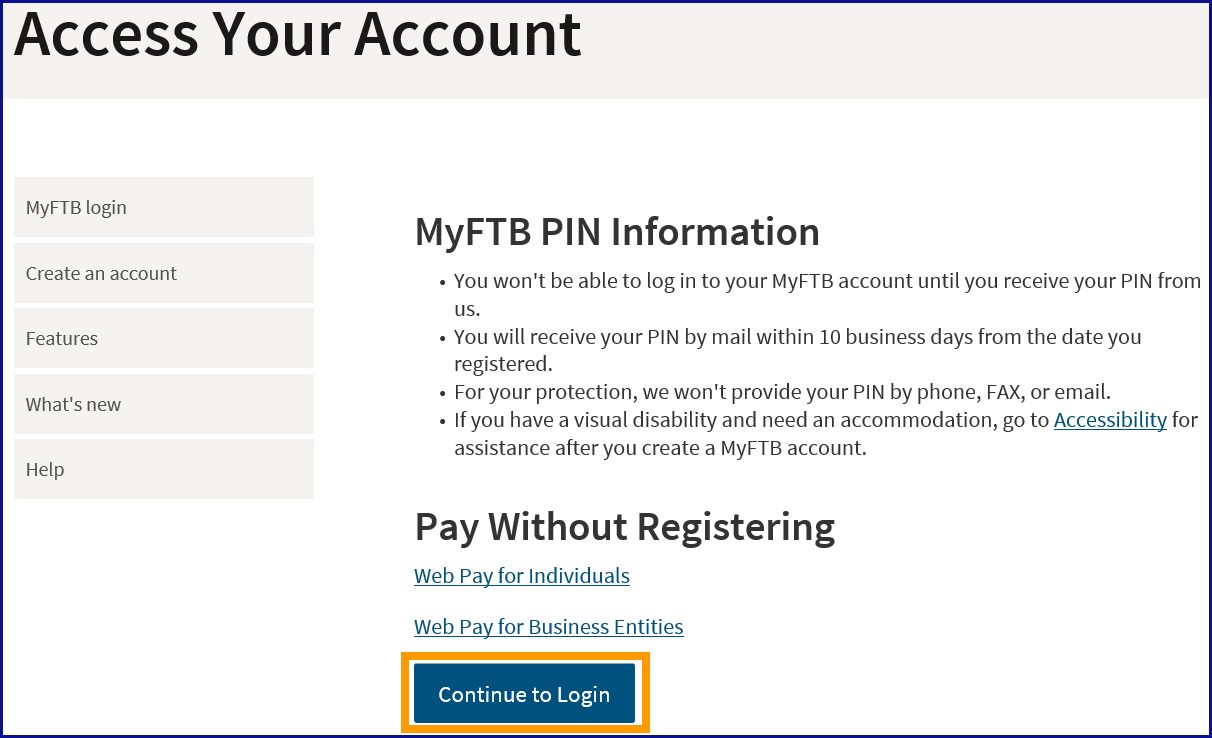

The FTB website provides online tools for filing taxes, checking the status of refunds, and accessing tax forms.

Publications and Guides

The FTB publishes comprehensive guides and publications that explain tax laws and regulations in detail. These resources are invaluable for both businesses and individuals.

The Future of the Franchise Tax Board

As California's tax landscape continues to evolve, the Franchise Tax Board California will play an increasingly important role in ensuring compliance and collecting revenues. Advances in technology and changes in state regulations will shape its future operations, making it even more efficient and accessible to taxpayers.

Technological Advancements

The FTB is continually adopting new technologies to improve its services. These advancements will enhance the taxpayer experience and streamline tax administration processes.

Regulatory Changes

Changes in state and federal regulations will impact the FTB's operations. Staying informed about these changes is essential for taxpayers to maintain compliance and avoid penalties.

Conclusion

In conclusion, the Franchise Tax Board California is a vital agency responsible for administering state tax laws and ensuring compliance. Understanding its functions and responsibilities is crucial for businesses and individuals alike. By staying informed and taking proactive steps to meet your tax obligations, you can avoid penalties and ensure financial stability.

We encourage you to explore the resources provided by the FTB and seek professional advice when needed. Share this article with others who may benefit from it, and don't hesitate to leave a comment or question below. Together, we can navigate California's tax landscape with confidence and clarity.