The Franchise Tax Board (FTB) of California plays a crucial role in the state's financial management and taxation system. Whether you're a business owner, taxpayer, or simply curious about how California handles its tax obligations, understanding the FTB is essential. This article delves into the ins and outs of the Franchise Tax Board of California, providing valuable insights for individuals and businesses alike.

The Franchise Tax Board is responsible for administering California's tax laws and ensuring compliance among taxpayers. It oversees various types of taxes, including personal income tax, corporate taxes, and more. For those navigating the complexities of California's tax landscape, the FTB serves as a key authority.

This guide aims to provide a detailed overview of the Franchise Tax Board of California, covering its functions, responsibilities, and the implications for taxpayers. Whether you're seeking information on filing taxes, understanding tax obligations, or exploring resources available through the FTB, this article is designed to equip you with the knowledge you need.

Read also:Mtn Nigeria Data Bundles

Table of Contents

- What is the Franchise Tax Board of California?

- Role and Responsibilities of the FTB

- Types of Taxes Administered by the FTB

- Understanding the Tax Filing Process

- Common Issues with the Franchise Tax Board

- Resources Available from the Franchise Tax Board

- Penalties for Non-Compliance

- Appeals Process for Tax Disputes

- Recent Tax Reforms and Updates

- Conclusion and Next Steps

What is the Franchise Tax Board of California?

The Franchise Tax Board of California is an agency responsible for administering state tax laws. Established to ensure that taxpayers comply with their financial obligations, the FTB plays a pivotal role in collecting revenue for the state. It operates under the California Department of Finance and is one of the largest tax agencies in the United States.

Key Functions of the FTB

- Administering personal income tax for residents and non-residents.

- Handling corporate taxes, including franchise taxes for businesses operating in California.

- Managing the collection of inheritance and estate taxes.

- Providing support and resources for taxpayers to ensure compliance.

The FTB's mission is to fairly and efficiently administer tax laws while providing exceptional service to taxpayers. By maintaining transparency and accountability, the agency aims to build trust with the public it serves.

Role and Responsibilities of the FTB

The Franchise Tax Board has a wide range of responsibilities that ensure the proper functioning of California's tax system. Its primary duties include:

- Enforcing Tax Laws: The FTB enforces state tax laws to ensure that all taxpayers meet their obligations.

- Collecting Revenue: It collects taxes owed by individuals, businesses, and other entities, contributing to the state's budget.

- Providing Assistance: The FTB offers resources and guidance to help taxpayers understand and comply with tax regulations.

Through its efforts, the FTB ensures that California has the financial resources needed to fund public services, infrastructure, and other essential programs.

Types of Taxes Administered by the FTB

The Franchise Tax Board oversees several types of taxes, each with its own set of rules and requirements. Below is a breakdown of the major taxes administered by the FTB:

Read also:Good Morning Prayer For My Man

- Personal Income Tax: This tax applies to individuals earning income in California, whether they are residents or non-residents.

- Corporate Franchise Tax: Businesses operating in California are subject to a franchise tax, which is calculated based on their net income.

- Inheritance and Estate Taxes: The FTB handles the collection of taxes on inherited assets and estates.

Each of these taxes has specific filing deadlines and requirements, which taxpayers must adhere to in order to avoid penalties.

Understanding the Tax Filing Process

Filing taxes with the Franchise Tax Board involves several steps, and understanding the process can help taxpayers avoid common pitfalls. Below is an overview of the filing process:

Steps for Filing Taxes

- Gather Required Documents: Collect all necessary documents, such as W-2 forms, 1099s, and other financial records.

- Choose the Correct Form: Select the appropriate tax form based on your tax situation (e.g., Form 540 for individuals).

- Submit Your Return: File your tax return electronically or by mail, ensuring that all information is accurate and complete.

For those who prefer convenience, the FTB offers electronic filing options, which can expedite the process and reduce the likelihood of errors.

Common Issues with the Franchise Tax Board

While the Franchise Tax Board strives to assist taxpayers, some common issues may arise during the tax filing process. These include:

- Overpayment or Underpayment: Taxpayers may face challenges related to overpaying or underpaying their taxes.

- Missing Documentation: Failing to provide complete documentation can lead to delays in processing tax returns.

- Penalties and Interest: Non-compliance with tax laws can result in penalties and interest charges.

To address these issues, the FTB provides resources and support to help taxpayers resolve discrepancies and ensure compliance.

Resources Available from the Franchise Tax Board

The Franchise Tax Board offers a variety of resources to assist taxpayers with their tax obligations. These include:

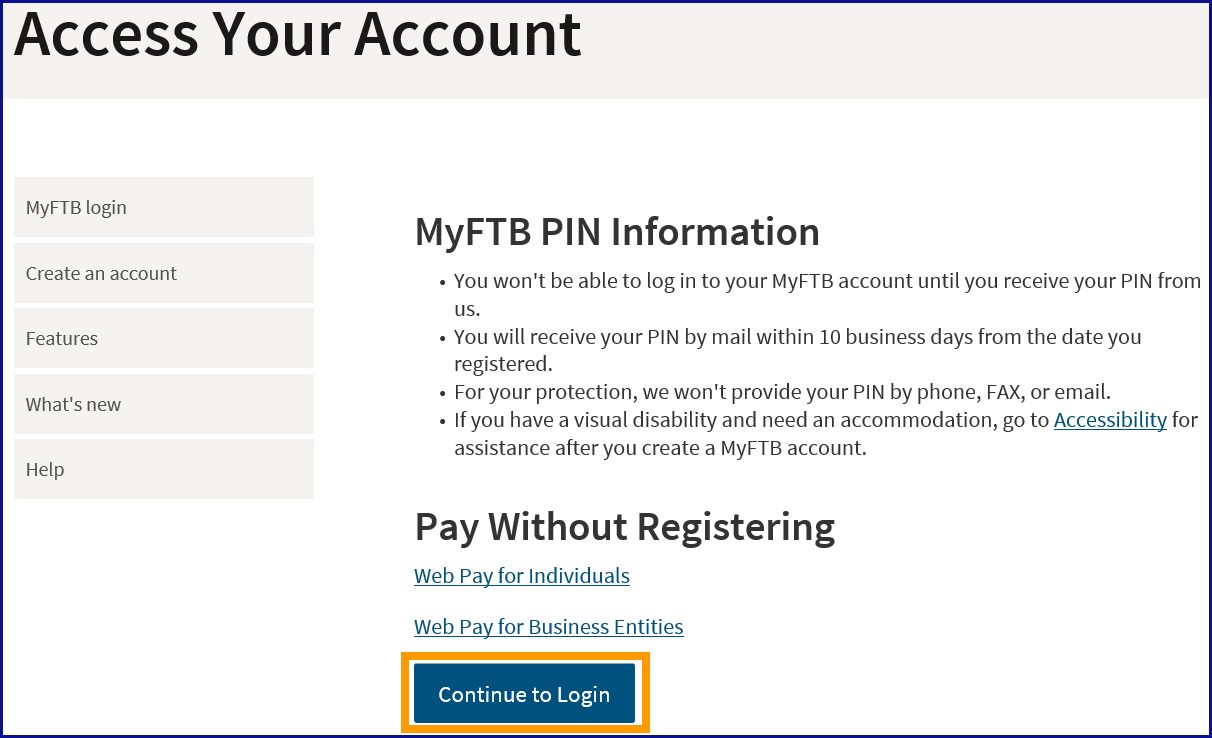

- Online Tools: The FTB website provides access to online calculators, forms, and filing options.

- Publications and Guides: Comprehensive guides and publications are available to help taxpayers understand tax laws and regulations.

- Customer Service: Taxpayers can reach out to the FTB's customer service team for assistance with specific questions or issues.

By leveraging these resources, taxpayers can streamline the tax filing process and ensure compliance with state laws.

Penalties for Non-Compliance

Failing to comply with California's tax laws can result in significant penalties. The Franchise Tax Board imposes penalties for:

- Late Filing: Taxpayers who file their returns after the deadline may face late filing penalties.

- Underpayment: Underpaying taxes can lead to interest charges and additional fees.

- Failure to Pay: Not paying taxes owed can result in severe penalties, including legal action.

Understanding these penalties and taking proactive steps to meet tax obligations can help taxpayers avoid unnecessary financial burdens.

Appeals Process for Tax Disputes

Taxpayers who disagree with a decision made by the Franchise Tax Board have the right to appeal. The appeals process involves:

- Submitting a Request: Taxpayers must file an appeal request within a specified timeframe.

- Providing Evidence: Supporting documentation and evidence must be submitted to substantiate the appeal.

- Receiving a Decision: The FTB will review the appeal and issue a final decision.

By following the appeals process, taxpayers can seek resolution for disputes related to their tax obligations.

Recent Tax Reforms and Updates

The Franchise Tax Board regularly updates its policies and procedures to align with changing tax laws. Recent reforms include:

- Increased Emphasis on Digital Filing: The FTB is encouraging more taxpayers to file electronically to improve efficiency.

- Changes to Tax Rates: Adjustments to tax rates have been implemented to reflect economic conditions and legislative changes.

- Enhanced Taxpayer Protections: New measures have been introduced to safeguard taxpayer rights and ensure fair treatment.

Staying informed about these updates can help taxpayers navigate the evolving tax landscape in California.

Conclusion and Next Steps

In conclusion, the Franchise Tax Board of California is a vital component of the state's tax system, ensuring that all taxpayers meet their obligations fairly and efficiently. By understanding the FTB's role, responsibilities, and resources, individuals and businesses can better manage their tax affairs and avoid potential pitfalls.

We encourage readers to take the following steps:

- Review the information provided in this guide to gain a deeper understanding of the Franchise Tax Board.

- Utilize the resources available from the FTB to ensure compliance with tax laws.

- Share this article with others who may benefit from learning about the FTB and its functions.

For further assistance or to explore additional topics related to taxation in California, feel free to explore our website or leave a comment below. Together, we can promote financial literacy and responsible tax management.

Data Sources: Franchise Tax Board of California, State of California, Internal Revenue Service.